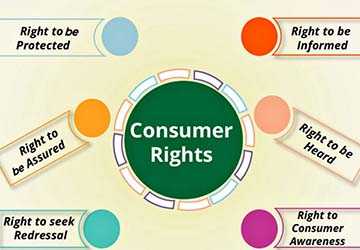

5 Rights Every Consumer Should Know When Dealing with Insurance Companies

Have you ever felt completely hopeless with your insurance company? You're not the only one. Many people need to become more aware of their rights and learn to be prepared when an insurance company decides to take advantage of them.

In this blog post, you'll learn about five essential consumer rights. This information will help you feel more confident and informed in every interaction with your insurance company.

A Basic Guide to Insurance Consumer Rights

Before we discuss five essential rights you should know, let us explain why knowing your rights can help you.

Knowing your rights means you don't have to approach insurance issues timidly or be afraid to take action when necessary. You recognize problems from the outset and can proactively deal with them.

As a well-informed consumer, you can be confident that you will receive comprehensive coverage and quality service from your insurance company.

1. The right to clear and accurate information

As with any other service, the law requires that all fundamental aspects of insurance be explained to you as the client; this also means you should know all your policy details, including any coverage limits, exclusions and total premiums.

Because these terms are complex, you must familiarize yourself with them or ask your agent questions until you understand them.

It will help you make informed decisions about future coverage and avoid unexpected insurance issues. So, learn everything you can to get the knowledge you deserve.

After all, knowledge is power, and the better you understand this concept, the less likely you are to get into trouble.

2. Right to fair claims settlement

Even if filing an insurance claim is difficult, as a customer, you have the right to expect your claim to be handled fairly and expeditiously.

Insurers must promptly process and review all claims and may not unreasonably deny or deny them. Don't be afraid to speak up if you're frustrated by your unfair procrastination.

Document all conversations with your insurance company and contact a professional if you need help. Remember that you have taken steps to pay your premiums on time, and the insurance company must handle your claim with the utmost professionalism.

3. Right to appeal against decisions

Sometimes, things don't go as you imagined or are unfair. Regardless of the details, you have the right to appeal any decision that you feel is unfair.

Your insurance company must explain how you appeal and is required to evaluate the appeal in good faith. Even if your first appeal is denied, you can take it to the next level of appeal, which will refer it to an external reviewer.

The most important thing is persistence. If you feel something needs to be corrected, fight for your position until you've done everything possible.

4. Right to privacy and confidentiality

As a consumer, your privacy is your sanctuary; your insurance company will take this very seriously. By law, insurance providers must take all necessary steps to secure your personal information and prevent unauthorized access.

Therefore, you can easily voice your complaint if you feel that your privacy has been violated. You can file these complaints with your insurance company's data protection officer and refer the matter to the relevant authorities if not dealt with professionally.

It is also essential to understand that privacy is a right, and you, as the customer, have the power to ensure that your insurance company respects this right.

5. Right to change provider

If you are not satisfied with the service or coverage from your current insurance company, there is no reason to stay. You never want to feel stuck in a contract where your coverage and services don't meet your expectations and standards.

First, shop around and compare policies. Don't be afraid to ask questions or request more from your insurance company. You can find the right coverage from the right insurance provider by combining your needs and value with their costs and offers.

Take control of your insurance experience.

Every consumer should have five fundamental rights when dealing with insurance companies. However, we need more than just these rights, from the right to easy access to information to the right to change insurance providers.

There is no choice but to err on caution, ensure potential risks are covered, and get the right help. So why act now?

Act now to protect your financial future from danger and uncertainty.